This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

Welcome to your new First Bank account.

Getting started is easy.

-

Hello

You! -

Step OneDigital

Tools -

Step TwoComplete

the Switch -

Step ThreeRewards

Credit Card -

Step FourKnow Your

Options

We’re glad you want to get the most out of your new account.

Before you get started, here are a few things to look out for and a brief survey to help us know how we’re doing.

Download the app.

Ready to start banking from your mobile phone? We’ll text you a link in a secure message that will take you to the appropriate app for your device. Make sure to select whether you have an iPhone or Android device below.

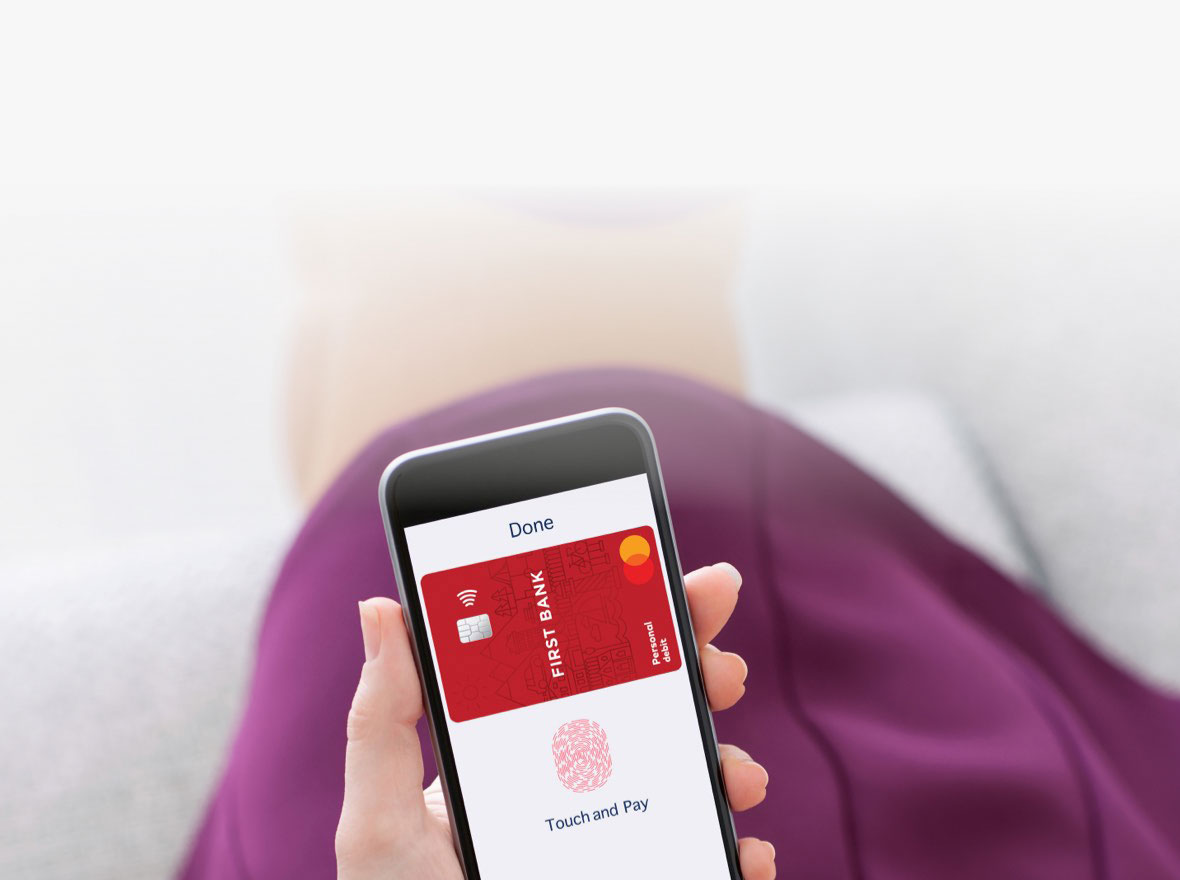

Ready to use your money on the go?

The First Bank Digital Banking Apps are available for select mobile and tablet devices. There is no charge from First Bank, but message and data rates may apply.

Must enroll in First Bank Online Banking and download the First Bank Digital Banking App from the App Store or Google Play.

Apple, the Apple logo, and iPhone are trademarks of Apple, Inc., registered in the U.S. and other countries. App Store is a service mark of Apple, Inc. Android and Google Play are trademarks of Google Inc.

A flexible card that fits your priorities.

The Platinum Rewards Mastercard® earns more back for you.

- Enjoy a 0% introductory APR for the first 9 months. After 9 months, a variable 17.40 – 27.40% APR will apply.*

- Get $0 balance transfer fee*

- Earn 1 point for each $1 spent on qualifying purchases

Use your card to earn rewards.

Every time you use your card you’ll earn points for every qualifying dollar you spend.

Pay At The Pump

Fill up for less when you use your rewards card and redeem your points at participating gas stations. Save $0.50 off per gallon, up to 20 gallons.

Turn Reward Points Into Gifts

Give the gift of flexibility when you share your points with friends and family using Point Gifting.

See our Terms and Conditions for complete details on our Mastercard® programs. Loan subject to credit approval. ®2024 Mastercard. Mastercard, Debit Mastercard, and the Mastercard brand marks are trademarks of Mastercard International Incorporated.

*Rates current as of 5/22/23. APR will vary based on the Prime Rate and your creditworthiness. There is no minimum interest rate charge and there is no annual fee. See our Disclosure Summary for complete details. Loans subject to credit approval.

It’s simple to switch

Use this guide to close your account with another financial institution and transfer your funds to First Bank.

What you need on hand:

- Your new First Bank checking account and the bank’s routing number: 053104568

- Your old bank account and routing numbers

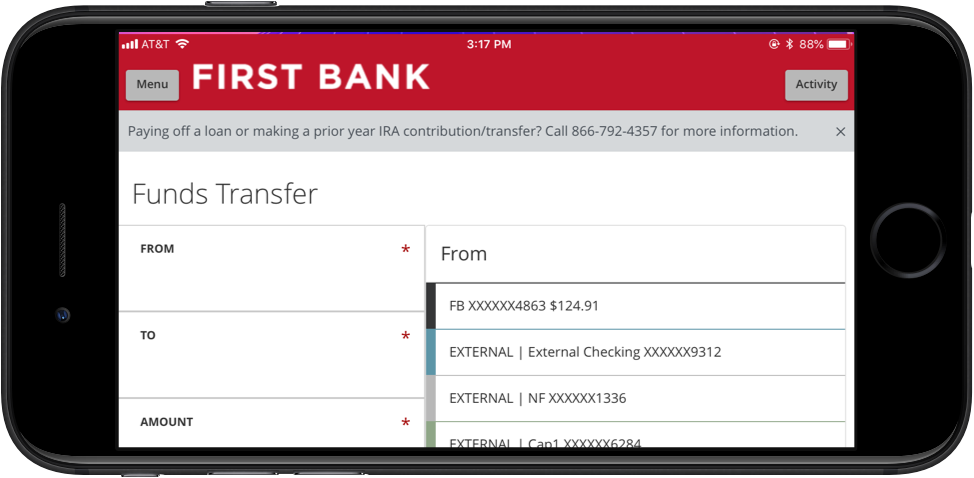

- The First Bank mobile app to set up your new bill pay, funds transfer, and MyMoney financial management goals

Follow these six simple steps.

Step OneDownload the First Bank mobile app

Step TwoChange your direct deposit to First Bank

Step ThreeLink accounts

Link your old and new accounts by logging into your First Bank account, then click “Payments and Transfers,” and then “Add External Account.”

Step FourStop using your old account

Monitor your old account to be sure to avoid any fees for dropping below any of the monthly account requirements. It may be helpful to also review the past few months (or year) of statements for recurring payments. Identify any lingering checks written from your old account, monitor their status and ensure they are all cleared before you close out the account.

Step FiveSwitch auto-drafts and online payments to your new account

Consider your cable or phone bill and accounts with sites like Amazon, Netflix, and Apple Pay. Make sure you update the info on each to your new First Bank debit card or account.

Step SixClose your old checking account (if applicable)

Withdraw any remaining money and follow the guidelines of the institution for closing your account.