This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

Business Online Banking Updates for Fall 2023

In an effort to improve your online banking experience, we’ve added new and improved features to make managing your finances online more efficient. With these new added capabilities you will have more information about your transactions available at your fingertips, and can utilize online banking tools with greater ease. Explore the online banking updates coming soon:

Redesigned Activity Center

The Activity Center has been redesigned to make transaction data easier to find and work with. We’ve updated how filters can be managed to make it easier for you to find the transactions you are looking for.

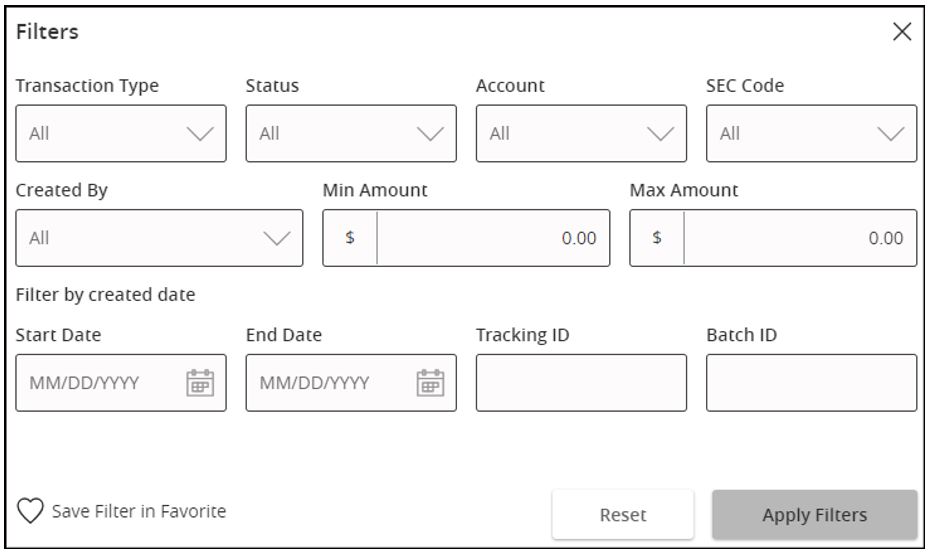

Updated Filters Layout

The ability to apply filters when searching for specific transactions has been improved. You can now also save a filter as a favorite, allowing you to easily navigate to the transactions you need to find on a consistent basis.

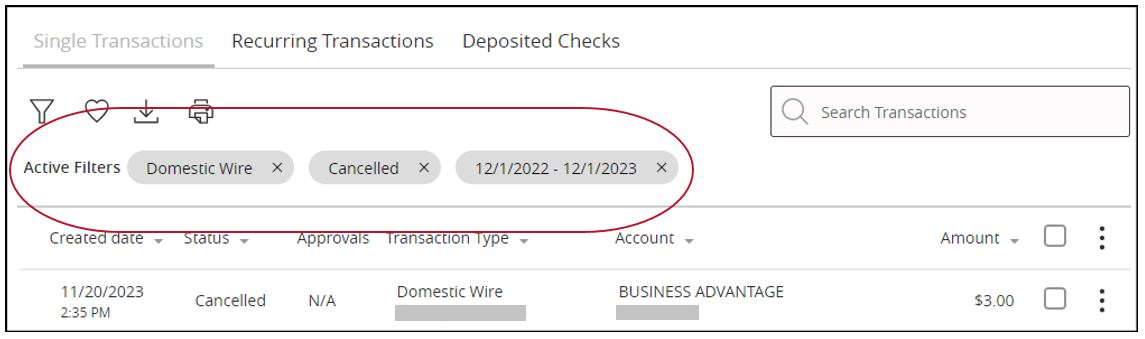

Active Filters

After applying multiple filters, it can be hard to tell which are being used to display a list of transactions. That is why we added a quick view of the active filters you’ve applied. You will now have the ability to see which filters are currently being used at a glance and can individually dismiss the ones you no longer need.

ACH Features

Managing ACH payments through online banking is now even easier. We’ve added the ability to make bulk file copies and made viewing ACH pass-thru details more efficient.

Expanded Recipient File Sizes

Great news for business owners and managers that have to manage a large amount of ACH recipients, you will now have the ability to copy files with more than 1,000 recipients within the Activity Center. Using the read-only view available through the bulk ACH workflows, you can manage your bulk recipients copies with ease.

NOTE – for file copies with less than 1,000 recipients, you will maintain the current workflow, including the ability to edit.

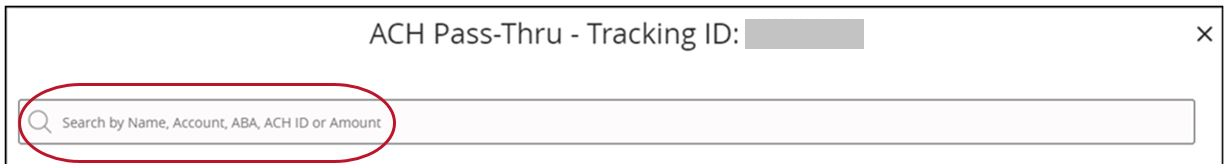

Additional ACH Pass-Thru Details

You now have the ability to view searchable transaction details and more information about failure statuses through View Full Pass-Thru Details. You can easily search by name, account, ACH ID or amount to find the ACH transaction you need.

Loan Payments Portal

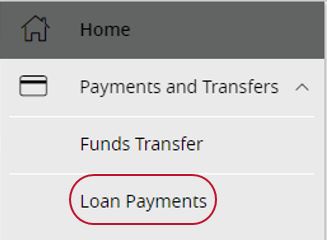

Previously, all loan payments were processed under the Funds Transfer option within your online banking. Now, we have a dedicated Loan Payments portal that allows you to easily make payments to your loan and ensure they are posted correctly to your account.

Any existing future or recurring payments that have already been submitted through the old process will not have to be updated or re-entered through the new Loan Payments portal unless edits are required. If you need to change anything on a recurring payment set up through the previous process under Funds Transfer, you will need to cancel it and set it up through the new portal.

Processing Loan Payments through the New Portal

To ensure your online loan payments process in a timely and error-free manner, navigate to the new Loan Payments portal under Payments and Transfers.

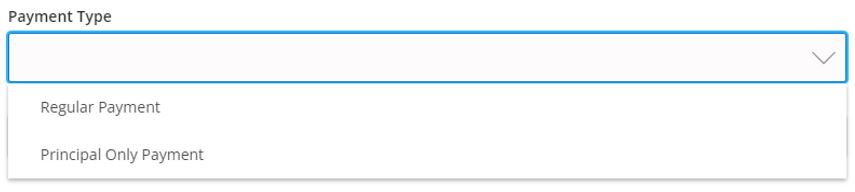

Once you are in the new Loan Payments portal, you will have the ability to specify the type of payment you are making. You’ll be able to make regular payments or additional principal only payments to your loan without having to make a trip to the bank.

NOTE – if you need to make any other type of loan payment other than Regular Payment or Principal Only Payment, you will need to visit your local branch so they can ensure your payment posts properly.

Withdrawals from Lines of Credit

While you will need to use the new Loan Payments Portal when making payments to your loans, you will still use the same process you’ve been using to withdraw funds from a Line of Credit. To draw from your Line of Credit you will navigate to the same Funds Transfer option that you have been utilizing.

Have Questions?

We’re here to support you as you navigate the new and exciting features of your online banking.