This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

Welcome to your new First Bank account.

Getting started is easy.

-

Hello

There! -

Step OneDigital Tools

-

Step TwoKnow Your Options

-

Step ThreeRewards Credit Card

We’re glad you want to get the most out of your new account.

Take a few minutes to click through the steps above for quick tips on maximizing the benefits for your business.

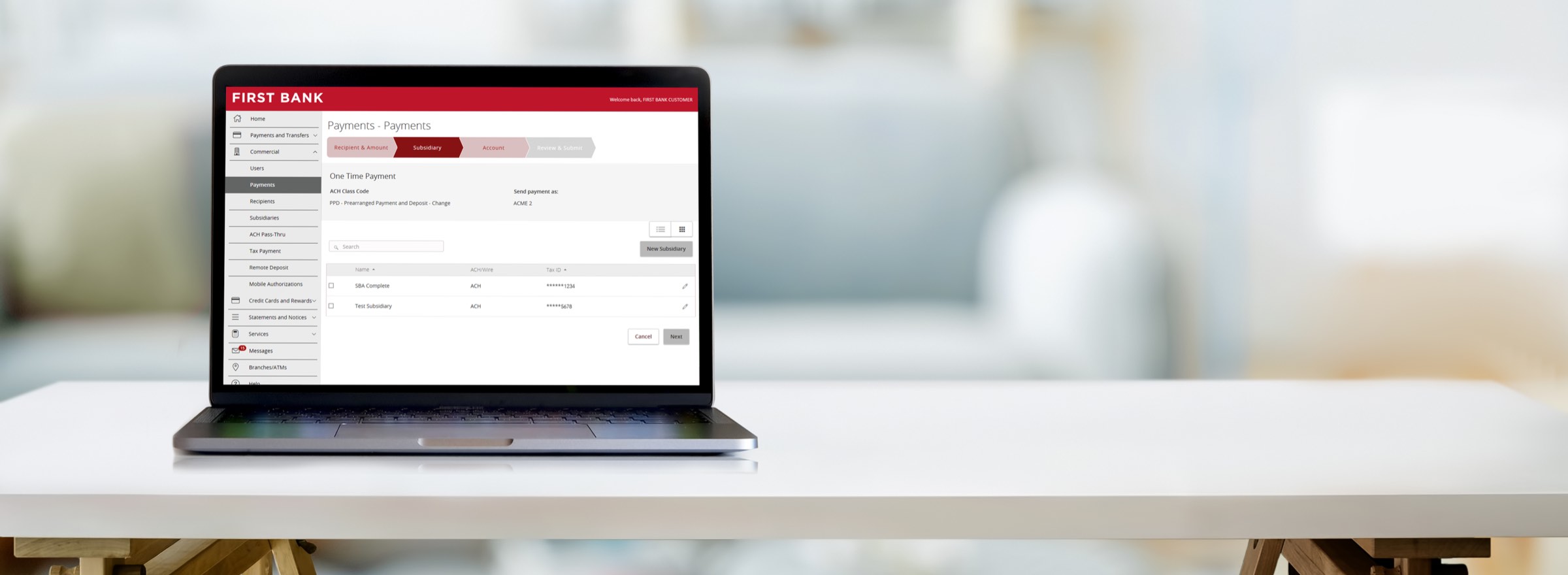

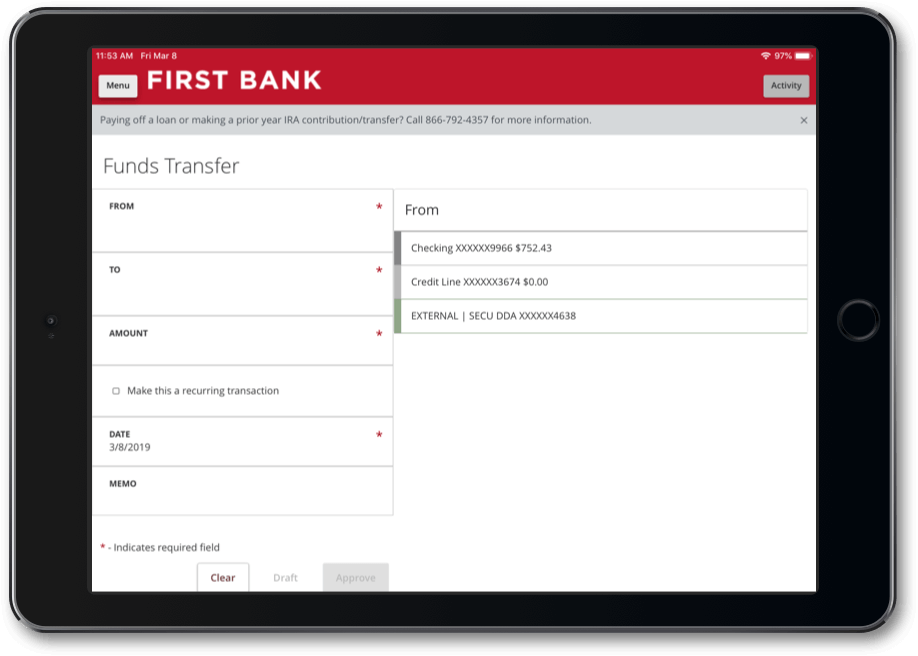

Do business from anywhere.

Get things done with hassle‑free business banking on your smartphone, tablet, or personal computer. Pay your bills while opening up shop in the morning. Deposit a check with your smartphone during the lunch rush. Transfer funds between offsite client meetings.

Ways to use your money on the go

The First Bank Digital Banking Apps are available for select mobile and tablet devices. There is no charge from First Bank, but message and data rates may apply.

Must enroll in First Bank Online Banking and download the First Bank Digital Banking App from the App Store or Google Play.

Apple, the Apple logo, and iPhone are trademarks of Apple, Inc., registered in the U.S. and other countries. App Store is a service mark of Apple, Inc. Android and Google Play are trademarks of Google Inc.

Get rewarded for your business expenses.

- Enjoy a 0% introductory APR for the first 9 months. After 9 months, a variable 17.40 – 27.40% APR will apply.*

- Get $0 balance transfer fee*

- Earn 1 point for each $1.25 spent on qualifying purchases

Use your card to earn rewards.

Every time you use your card you’ll earn points for every qualifying dollar you spend.

Pay At The Pump

Fill up for less when you use your rewards card and redeem your points at participating gas stations. Save $0.50 off per gallon, up to 20 gallons.

Turn Reward Points Into Gifts

Give the gift of flexibility when you share your points with friends and family using Point Gifting.

Maintain, grow or start your business.

See our Terms and Conditions for complete details on our Mastercard® programs. Loan subject to credit approval. ®2024 Mastercard. Mastercard, Debit Mastercard, and the Mastercard brand marks are trademarks of Mastercard International Incorporated.

*Rates current as of 5/22/23. APR will vary based on the Prime Rate and your creditworthiness. There is no minimum interest rate charge and there is no annual fee. See our Disclosure Summary for complete details. Loans subject to credit approval.