This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

3 Steps to Creating a Strong and Unique Password

Step One: Change It Up

The first step to protecting yourself from data breaches is defining secure phrases for your different accounts in order to alleviate risk. The consider the following tips to remember when selecting a password:

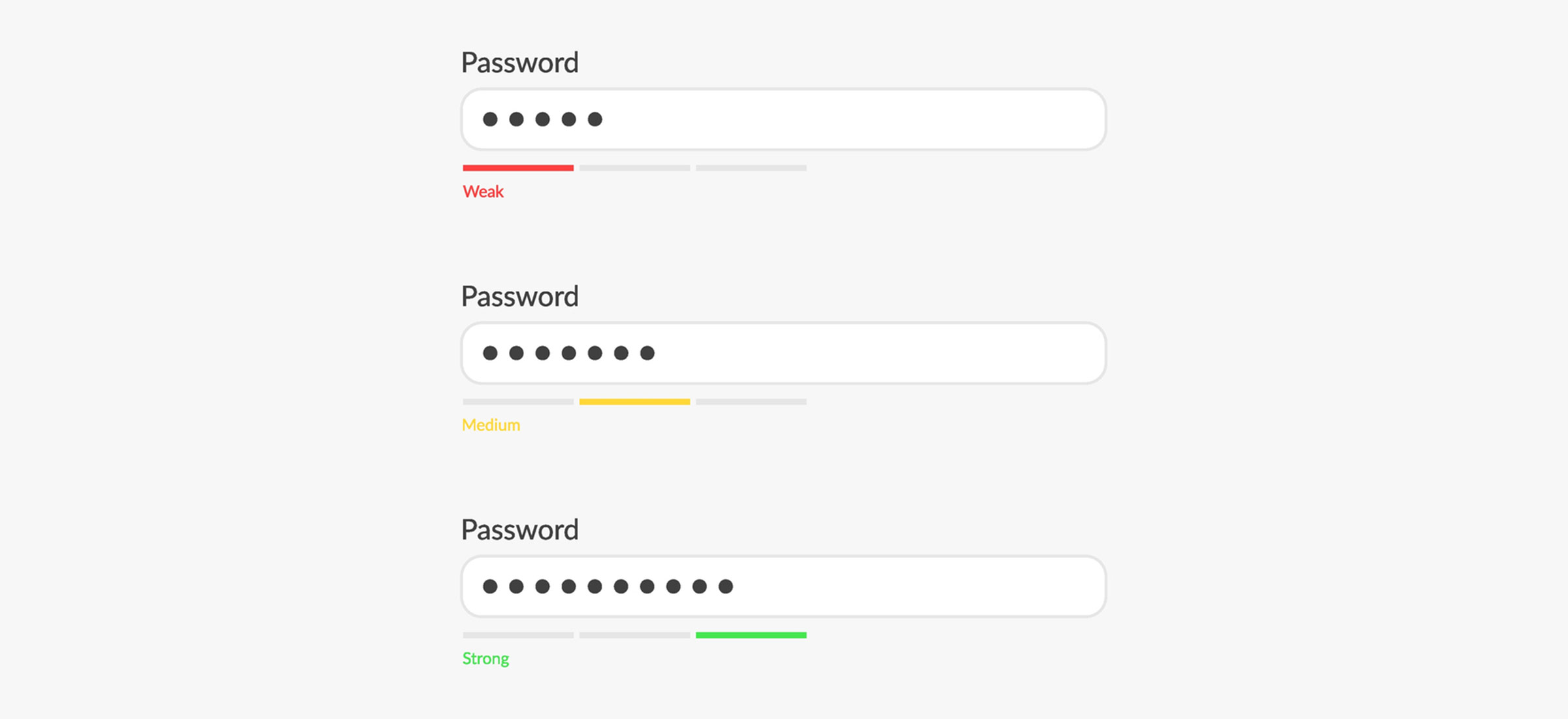

- Make sure your password is at least 12 characters

- Include upper-case and lower-case letters throughout

- Avoid keyboard paths like 45678 or asdfg

- Add punctuation marks within the password not just at the end

Step Two: Make it Meaningful

While there is strength in a lengthy password, trying to remember an array of random letters, symbols, and numbers such as YP&3U6?@DM2$ may be difficult; therefore, it is beneficial to use phrases meaningful to you, but ambiguous to others.

Instead of using easily predictable passwords containing information shared online such as birthdays, anniversaries, or family names, try relating it to your favorite hobby, food, or movie in order to better protect yourself.

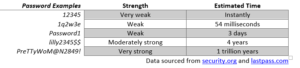

For example, creating a password that combines your favorite movie and the last 4 digits of your best friend’s phone number like PreTTyWoM@N2849! ensures that cybercriminals cannot effortlessly hack your account.

Here is a chart designed to help you better understand how easily a cybercriminal can guess your password and the time it would take for you to be hacked.

Step Three: Keep It Secret, Keep It Safe

The more complex your passwords, the easier it is to forget a character and get locked out. So, what’s the best solution to keep everything straight and safe?

Online: Storing passphrases on your phone or computer or sending them through email or text often seems like a convenient hassle-free solution, but it creates the opportunity for hackers to obtain private information.

Offline: Writing down your passwords can be the safest way to store your information, but it is still crucial to not record them word for word. Sadly, fraud often times comes from internal sources like friends or family members; therefore, it is vital to protect your passwords even when they are written down so that they cannot be easily copied and used later. It’s also all too easy to throw out or lose that slip of paper that might have all your carefully established information.

Solution: Rather than writing out each password, regardless of whether you choose online or offline storage methods, the trick is to give yourself a clue or hint. For example, in the sample password above, which includes your favorite movie and the last 4 digits of your best friend’s cell, your clue could be “Favorite movie, BFF #.”

By writing down a hint, you are better prompted to remember the information included within the password, while also keeping your passphrases secure.

If you prefer an online solution, there are multiple password manager options available. A password manager is an encrypted software used to help individuals manage their credentials within the database using a master passphrase. Be sure to vet your options carefully.

Don’t Share: Deceiving Requests

If someone asks you for your password via email, phone or text, be alert. Reputable businesses will never ask for your password through these methods. If you are unsure about a suspicious email, the best course of action is to avoid clicking on any links or attachments until you can be sure it is safe.

Want more security best practices and fraud prevention tips? Check out our free Identity Protection course or the many articles in our Learn library.