This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

Get ready for exciting updates coming to your credit card

Coming May 2024:

All credit card holders will be mailed a new card with a new credit card number the first week of May.

On May 20, activate and start using your new card.

The week of May 20, update your mobile app to unlock new credit card management tools that are conveniently located within mobile and online banking.

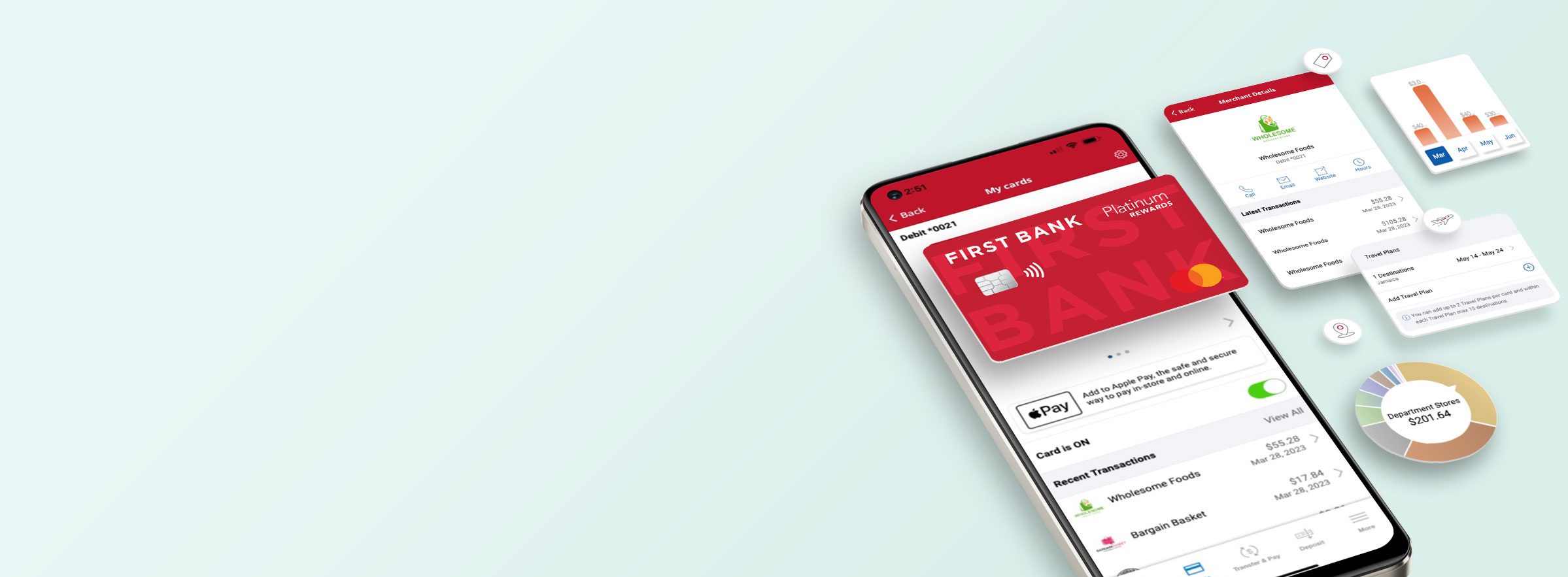

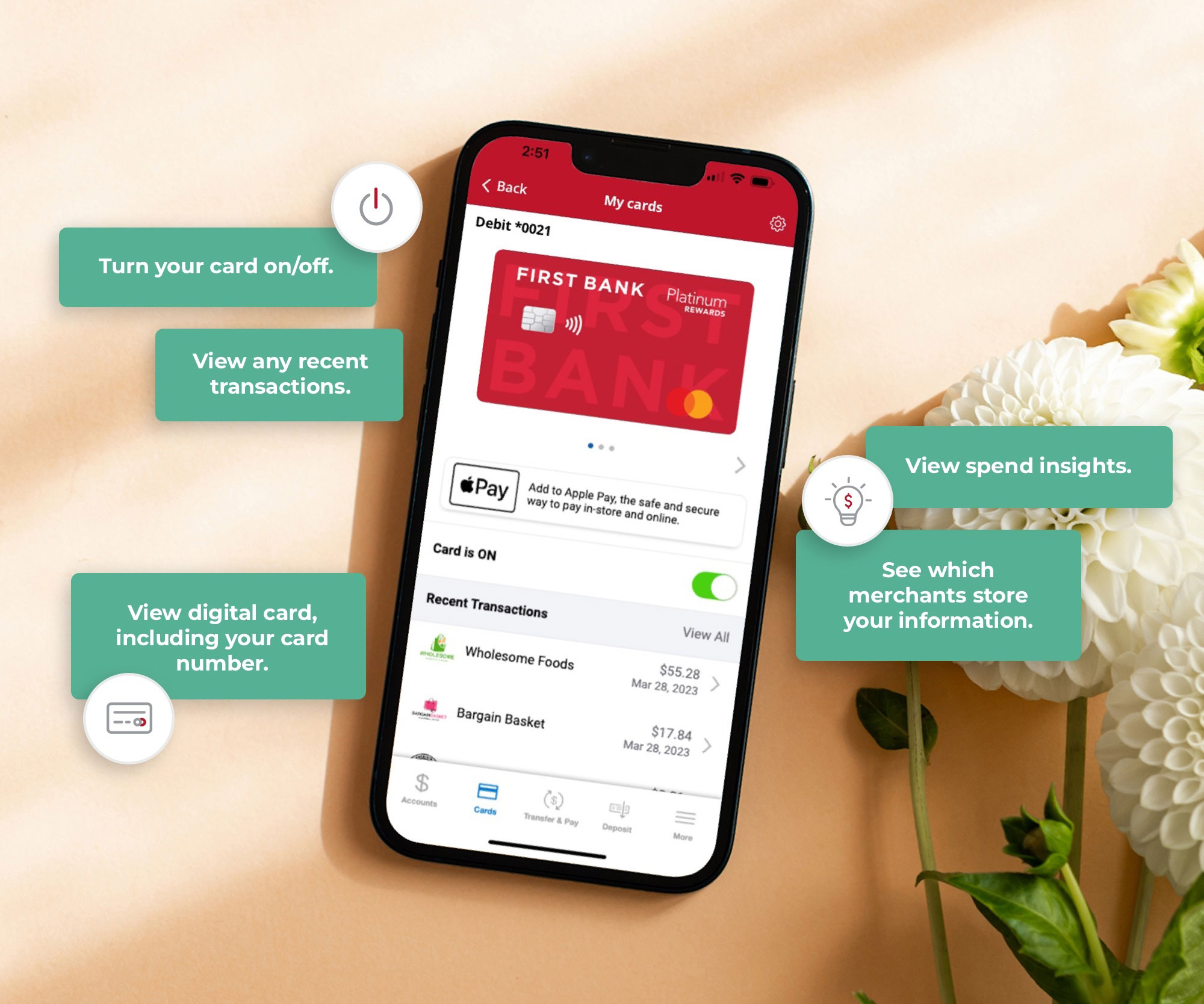

In addition to your new credit card, you’ll also have new credit card management capabilities within mobile and online banking. Your credit card will be completely integrated into our First Bank mobile application – providing a more robust and convenient credit card management experience.

You are going to love these updates.

Integrated credit card management

- Access your credit card without leaving your First Bank online banking profile or your First Bank mobile app.

- Control your cards on your terms and turn your cards on/off at your discretion.

- Set spending limits based on location, amount, merchant type and transaction type.

- Easily dispute transactions.

We’ll keep you in the loop.

We’ll be mailing and e-mailing you information about your credit card and about these exciting updates. Please be sure to check in with your local branch to make sure your contact information is up to date, or if it’s more convenient, you can sign into online banking to securely ask a question or update your details.

What to expect:

- Early May New credit cards will be issued to all credit card holders. If you share a credit card number with another card holder, you will be issued a new credit card number.

- May 20 The EZCardView option in your online banking sidebar will be replaced with ‘Manage Card’.

- May 20 Activate and start using your new card.

- Week of May 20 Update your First Bank mobile app to access these new credit card features on your smartphone. Click here for more information about our mobile app.