This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

Autobooks

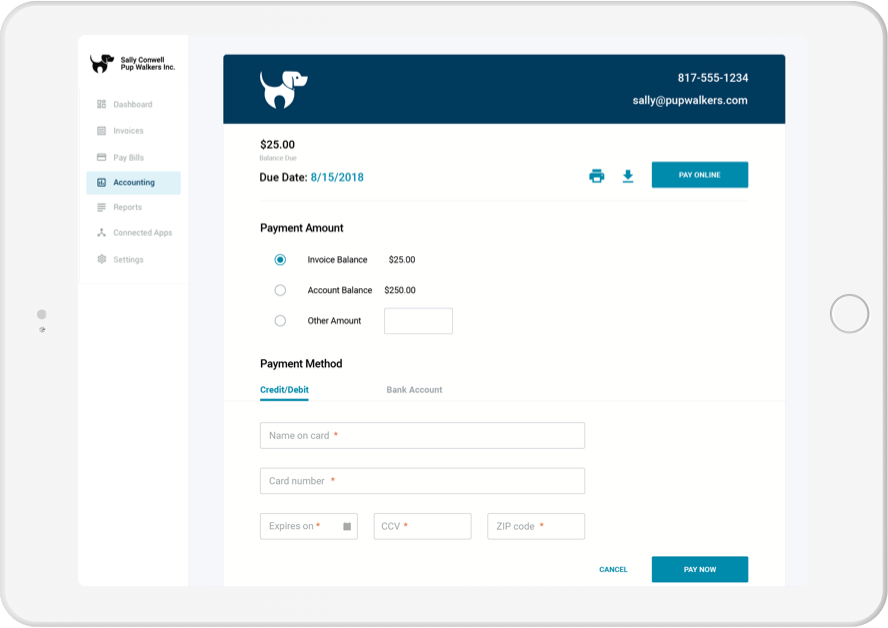

seamlessly integrated and available

within online and mobile banking.

Manage your books the easy way.

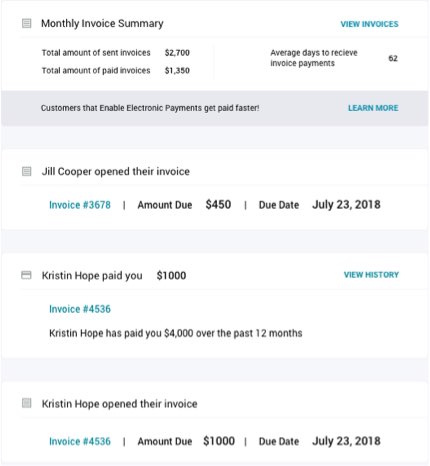

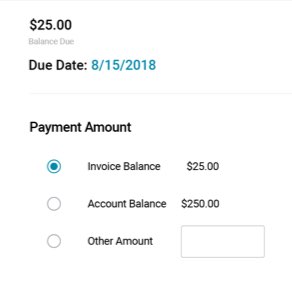

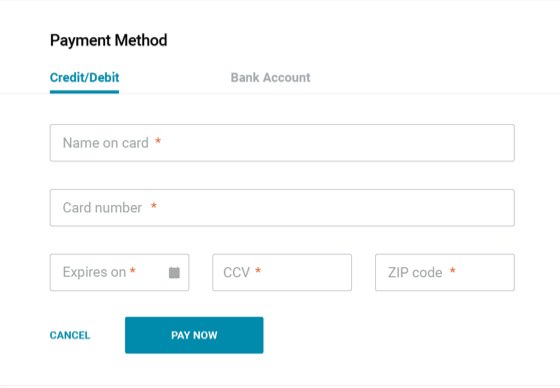

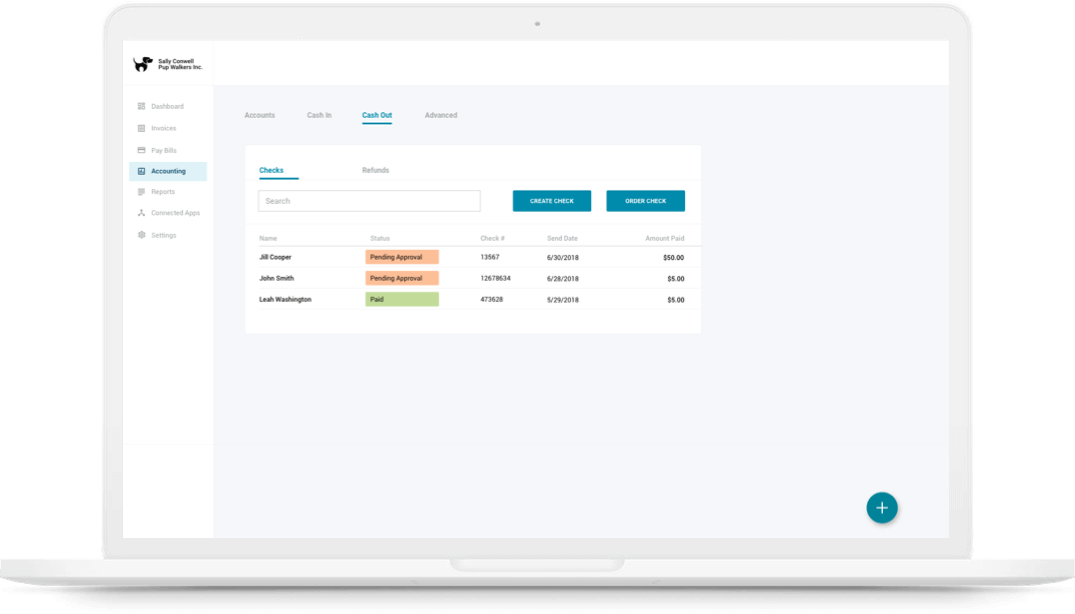

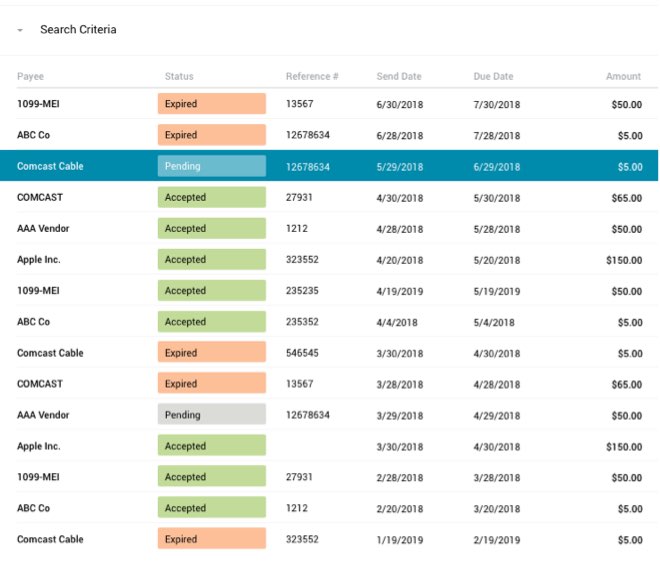

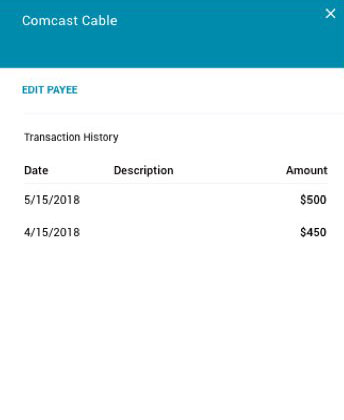

Autobooks automatically creates invoices, accepts payments and pays bills so you can focus on growing your small business.

- You need a convenient digital tool to manage your business

- You need to track invoices and expenses

- You are looking for an accounting solution

- You need to manage and pay bills

Option 1

- No monthly fee

- Accept payments and issue invoices

- Typical payment processing fees apply

Option 2

- $9.99 per month

- Accept payments and issue invoices

- Typical payment processing fees apply

- Full payables, accounting, and reporting package and capabilities