This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

New Year, New Budget

Maybe you’re in a similar situation, or maybe you just want to make sure that as you start a new decade, you set yourself up for financial success. Either way, it’s vital to make sure you have a solid budget in place and a good plan for how to move forward. And luckily, First Bank is here to help.

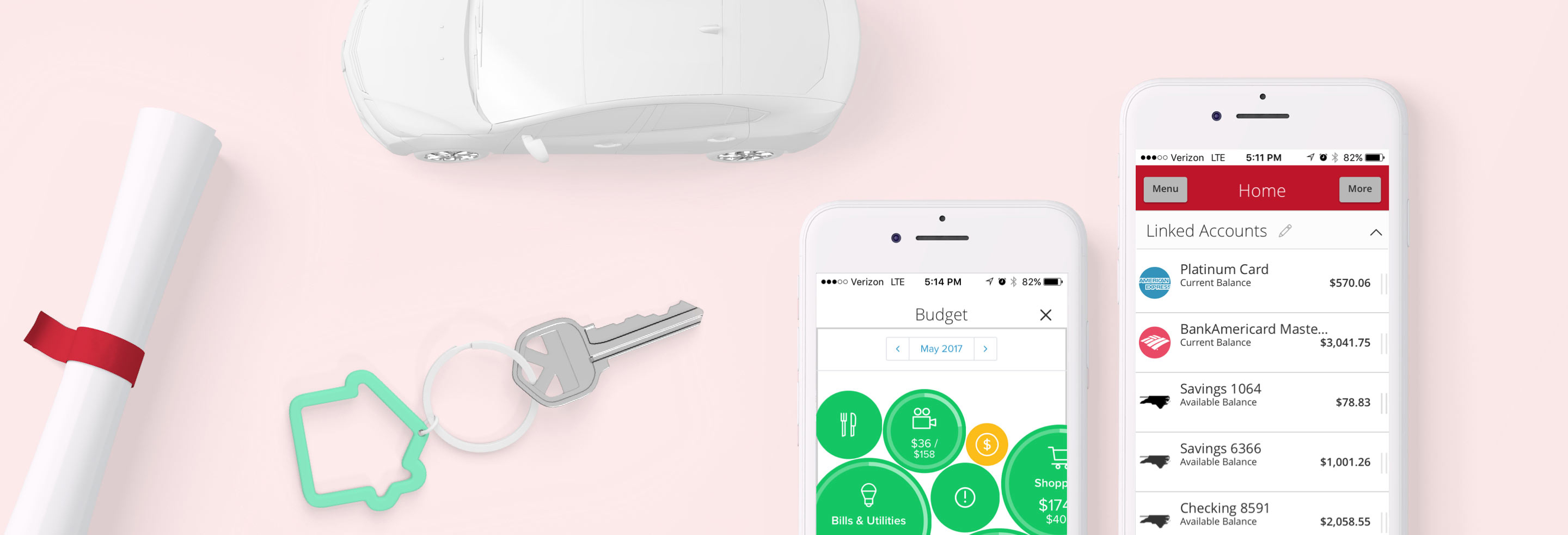

Did you know that you can link all of your financial accounts in online banking, and at a glance, see an overview of your transactions and balances?

Additionally, from the Account Overview page, you can click a link to access a budget or expenses.

By creating categories for your purchases, you can visualize where your money is going, more easily budget for what you need, and cut down on extraneous costs. For example, if you spot that you’re overspending on restaurants and entertainment, there may be subscriptions you don’t use that you could cancel, or more nights you can cook at home.

You can also add and then see all your credit card balances in one place. This allows you to calculate how making extra payments can affect your debt over time. Modifying the payoff approach will reorder the accounts in the order of priority/focus for that particular plan (for example, highest percentage, smallest balance, etc.).

Budgeting and tracking spending long-term is great and all, but what about when something unexpected happens? With text banking, you can set up when and how you want to be notified.

Some types of alerts include:

- Your checking, savings or credit line balance is above or below an amount you specify

- A withdrawal, deposit or check posts to your account

- A transfer has processed successfully or has failed to process

- An e-bill is ready to review

- A bill payment has been sent

- A bill’s due date is approaching

- Your credit card payment is due

You can also check on your accounts instantly with text commands. Using these you can:

- Check your account balance

- See your last 10 transactions

- Transfer funds between text-enabled accounts

- And more!

It’s nice for when you want to get updates on your account without opening the First Bank app or logging in to the website.

Talk to First Bank

We’ve saved the best for last, but one of the things that can truly help is to talk to your local First Bank branch associate. At every branch, you will find experts in budgeting, home buying, credit consolidation, and financial planning

We look forward to seeing you soon.