This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

Small Business Startup Loans – South Carolina

Get a Startup Loan from First Bank

Small business startup loans aren’t one-size-fits-all and that’s why your local First Bank offers five business loan options to meet the unique needs of businesses like yours. Each of our credit options provides you with competitive rates and flexible terms, giving you an edge over the competition. We provide our customers with:

- A business credit card with rewards benefits that offers lower rates and no annual fee.*

- Lines of credit that give you the ability to access cash quickly and conveniently.

- Business loans for long-term financing so you can expand your new business easily and quickly.

- Commercial mortgages that can be customized to meet your individual needs.

- SBA loans, which are government-sponsored loans provided through First Bank.

First Bank Success Story

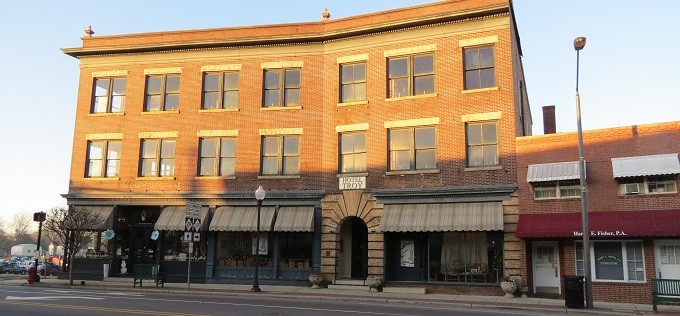

In 1918, Schofield’s Hardware Store in Florence, South Carolina, opened for the first time. Nearly 100 years later, Schofield’s is still providing its loyal Florence customers with a variety of products from clothing to paint.

“Whether it’s a traditional business loan, credit line, commercial mortgage, construction loan or business credit card, First Bank can provide the foundation you need to become your own success story.”

Our support for small businesses reaches well beyond startup loans. Check out our Financial Education Center to learn more about starting and running your own business, including:

- Evaluating a location for business potential

- Tips on marketing and social media strategies

- Cash management mistakes and how to avoid them

- Utilizing Google to help new customers find you

- Ways to grow a loyal customer base

Visit First Bank Today

Our resources for small business owners don’t end with startup loans. We also offer business checking accounts, savings accounts, treasury services, and more. To learn about our small business startup loans, visit one of First Bank’s South Carolina locations today.

*See our Terms and Conditions for complete details on our One Rewards Program. Loans subject to credit approval.

———

Sources:

Money Crashers: http://www.moneycrashers.com/new-home-construction-loan/