This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

Small Business Bank – North Carolina

North Carolina’s Small Business Bank

As a local bank with several locations in North Carolina, we go out of our way to lend a helping hand to small businesses. Here’s how we can serve your small business needs:

Loans

- Business Loans: Receive a lump sum of cash to finance everything you need to get your business off and running. Use the money to buy vehicles, inventory, equipment, or supplies.

- Credit Line: Use a business line of credit to make purchases as needed. The flexibility of this loan allows you to borrow and repay regularly.

- Business Credit Card: Take advantage of low rates, no annual fees, and a rewards program for eligible cards to back your small business needs. Use the card as often as you wish.

- Commercial Mortgages: Finance your place of business with First Bank’s competitive lending. Consult with our commercial mortgage experts for market area expertise and industry knowledge.

- Construction Loans: Use this option to pay for new construction, remodeling, or expansion of your building.

Business Checking and Savings Accounts

We offer 5 business checking accounts, 3 business savings accounts, and a group banking account.

Our checking accounts are:

- Business Essentials — Great for small businesses with basic banking needs.

- Business Interest — An interest-earning business checking account.

- Business Advantage — Good for established businesses with higher transaction volumes.

- Community Checking — Best for nonprofits and community organizations.

- Commercial Analysis — For business that need comprehensive management services.

Our savings accounts are:

- Business Savings — A basic account with a low minimum balance.

- Money Market — Offers higher rates and a high level of liquidity.

- CDs — Offers a guaranteed return with a fixed rate and choice of terms.

Our group banking account offers banking benefits for you and your coworkers, including:

- Free online and mobile banking*

Credit and Debit Cards

With a First Bank business debit or credit card you can enjoy many benefits, such as:

- Zero liability

- Worldwide acceptance

- Purchase assurance

- MasterCard Global Service®

Other Business Services

Merchant services. Easily accept and process credit and debit cards, checks, and gift cards from your customers.

Treasury services. Let First Bank support your daily cash flow needs, Remote Deposit Capture, Payroll Direct Deposit and Fraud Protection.

Online and mobile banking. Small business owners work long hours and with our online and mobile banking, so do we. Access your account and make transactions at any time from any location.

Visit First Bank Today

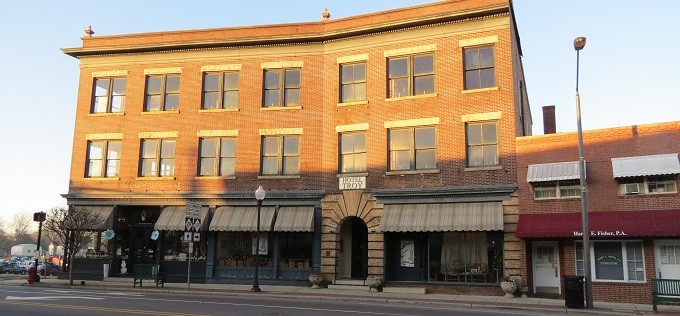

First Bank opened its doors right here in North Carolina in 1935 to help local farmers and small businesses manage their money during difficult economic times. This vision has continued for nearly 85 years since as we continue to operate as a leading small business bank in North Carolina.

See how First Bank can be your small business bank in North Carolina.

While First Bank does not charge for mobile banking, your mobile carrier’s message and data rates may apply.Requires free enrollment in each program. Rewards are based upon qualifying purchases as defined in the terms of each program. For additional information, see our website at One Rewards Program. See our Terms and Conditions for complete details on our One Rewards Program. Loans subject to credit approval.