Zelle® Request Demo

Digitally request money from friends, family and others you trust.

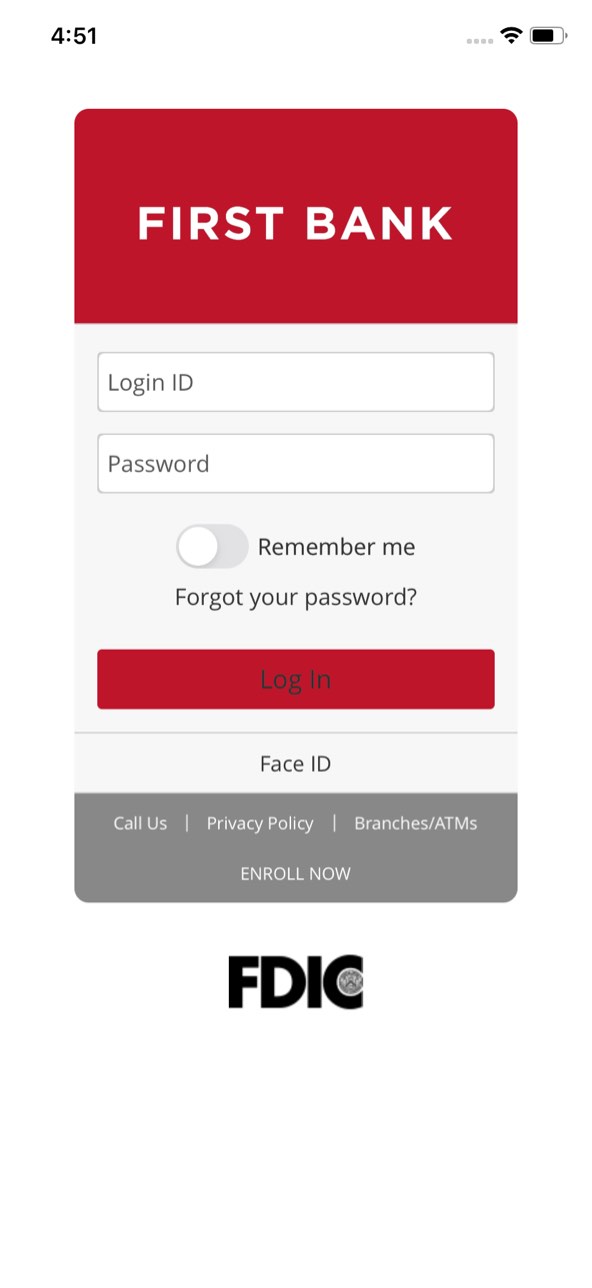

Step 1 Open the mobile app and log in.

When you enrolled in First Bank digital banking, you created a Login ID and Password. Enter that information in the corresponding boxes in the app and then tap the “Log In” button.

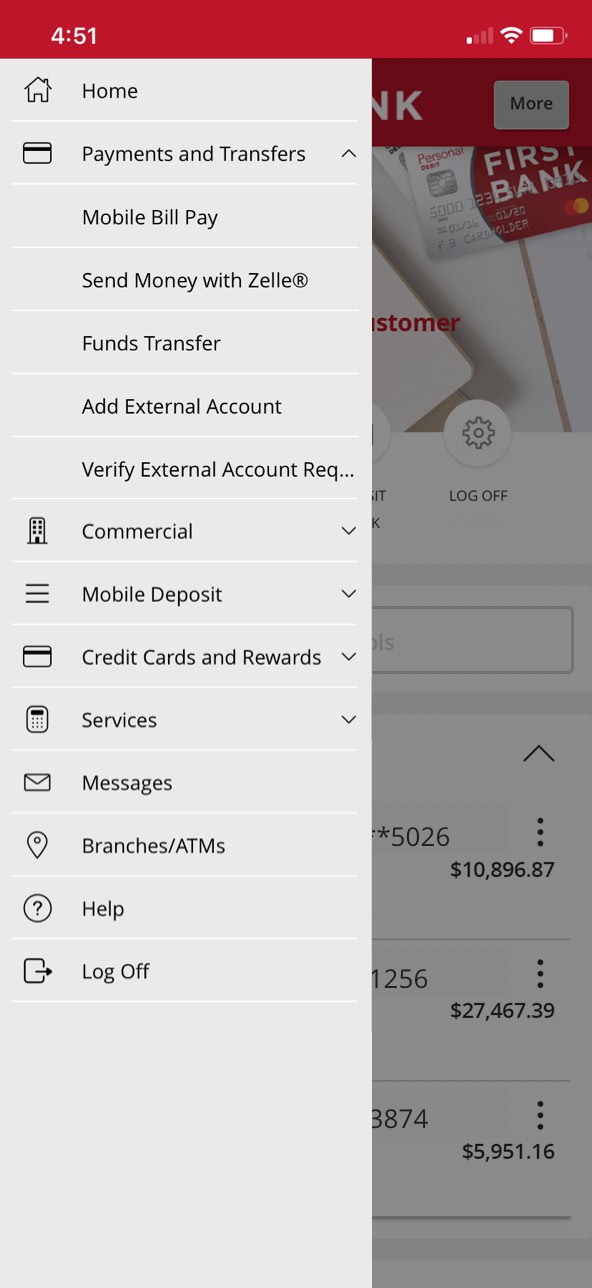

Step 2 Navigate to Send Money with Zelle®.

Tap on the “Menu” button in the upper left corner. From the dropdown menu, select “Payments and Transfers” and then tap “Send Money with Zelle®.”

Step 3 Tap Request.

To request funds be transferred to you, tap “Request.”

Step 4 Select the Contact(s).

From your contact list, choose who you want to request money from and tap their name(s).

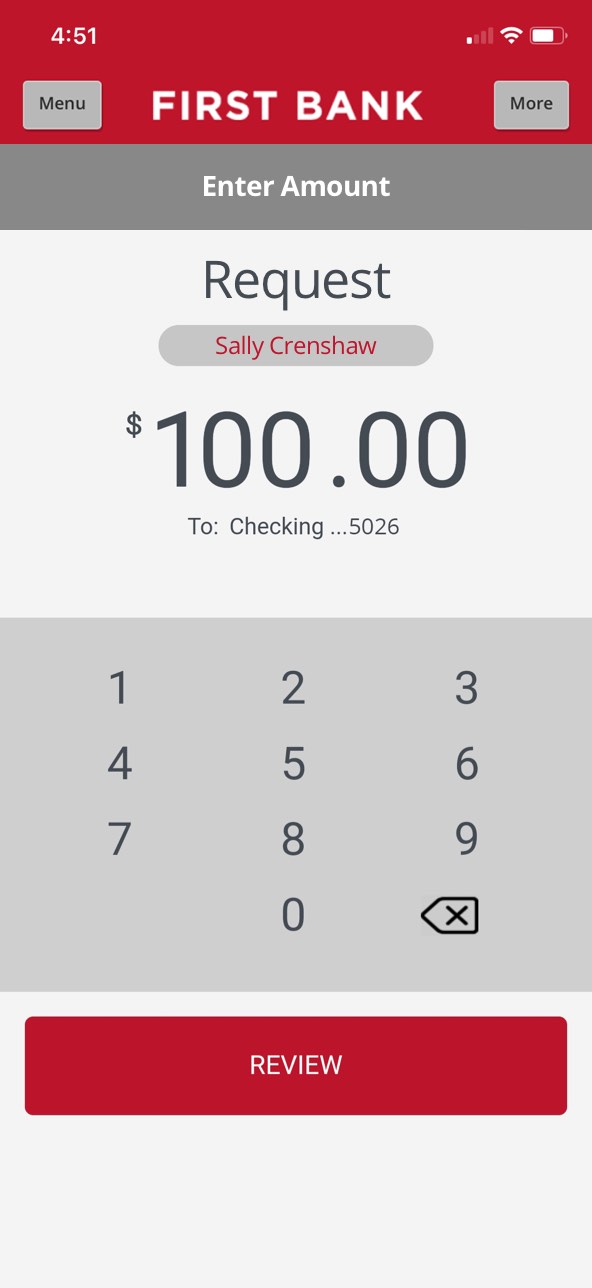

Step 5 Enter the requested dollar amount.

Type in the amount of money you are requesting from your contact, select the account you’d like the money to be deposited into, then tap “Review.”

Step 6 Enter request reason then tap request.

Type in a description of what the requested money is for, then tap the red “Request” button at the bottom.

Step 7 Tap the All Done button.

To complete your request, tap the “All Done” button and your contact will be notified.