This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

CardSwap Demo

Link your recurring payments and subscriptions to your new credit card.

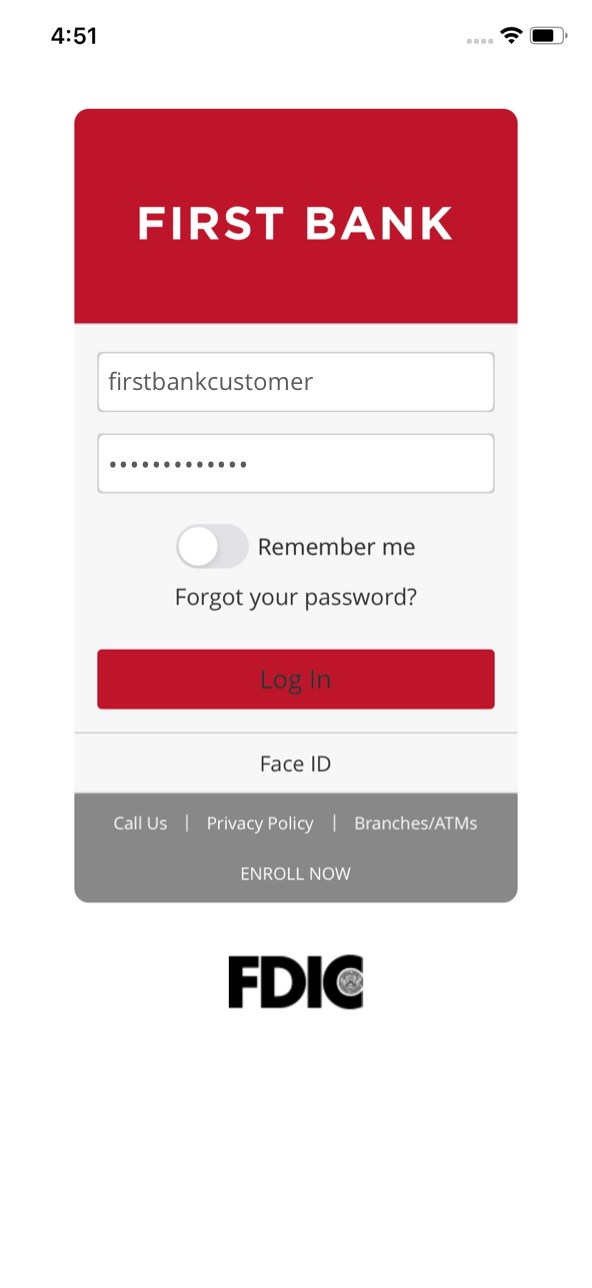

Step 1 Open the mobile app and log in.

When you enrolled in First Bank digital banking, you created a Login ID and Password. Enter that information in the corresponding boxes in the app and then tap the “Log In” button.

Step 2 Navigate to CardSwap.

Tap on the “Menu” button in the upper left corner. From the dropdown menu, select “Credit Cards and Rewards” and then tap “CardSwap.”

Step 3 Tap Get Started and accept the terms.

Press “Get Started” and the Terms and Conditions will pop up. Review the agreement and tap “I accept.”

Step 4 Select your services.

Tap all the services linked to your credit/debit card that you want to update payment information for, then tap “Next Step.”

Step 5 Enter your new card information, then tap Verify Card.

Input your new card, including the card number, expiration date, CVV, name on the card, and ZIP code. Then tap “Verify Card.”

Step 6 Complete the Security Verification.

For security purposes, enter the characters that appear in the box, then tap “Verify.” This will trigger a notification to your phone from each account that you will need to confirm. Next, hit “I’m finished.” Please allow 24 hours for the changes to be processed.