This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

Alerts Demo

Learn how to set up customized alerts for your accounts.

Step 1 Open the mobile app and log in.

When you enrolled in First Bank digital banking, you created a Login ID and Password. Enter that information in the corresponding boxes in the app and then tap the “Log In” button.

Step 2 Navigate to alerts.

From the dashboard, tap on the “Menu” button in the top left‑hand corner to make a dropdown menu appear. Select “Services” and then choose “Alerts.”

Step 3 Tap the +New Alert button and select alert type.

After you tap on the “+New Alert” button, a dropdown menu will appear listing the types of alerts you can set up on your account. Choose the type of alert you want.

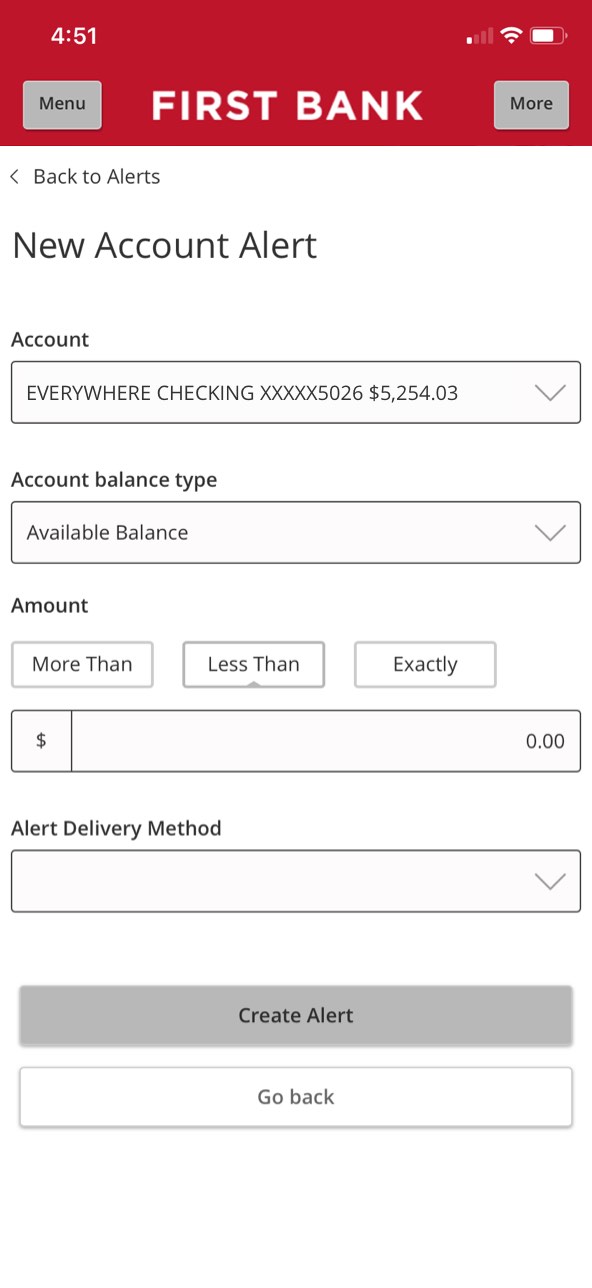

Step 4 Tap Account dropdown and select account.

When you tap on the “Account” button, a dropdown menu will list all of your First Bank accounts. Choose the account you want to set up an alert for.

Step 5 Tap Account Balance Type and choose one.

From the “Account Balance Type” dropdown list, choose the type of balance you want to be notified about.

Step 6 Tap More Than, Less Than, or Exactly.

You get to decide the threshold for your notifications. Choose from More Than, Less Than, or Exactly, and tap that button.

Step 7 Enter an amount.

Set a dollar value for your alert notifications that will be triggered based on whether you selected More Than, Less Than, or Exactly.

Step 8 Tap Alert Delivery Method and select a delivery method.

There are multiple ways you can receive your alerts. Tap “Alert Delivery Method” and choose from the dropdown list below.

Step 9 Tap Create Alert.

To finalize setting up the alert, tap the “Create Alert” button at the bottom of the screen. You will receive an alert each business morning when we detect your account meeting the parameters you set.